Sometimes the accounting rules and tax law are logical and equitable, sometimes they aren’t. When dealing with those accounting guidelines, however, one question always seems to surface: When is a shooting sports equipment business’s revenue considered “income?”

New accounting guidelines issued by the Financial Accounting Standards Board (FASB) offer requirements for determining how and when income should be accounted for.

Obviously, revenue/income is a critical financial measure for every tactical retailer. In addition to its impact on every operation’s tax bill, revenue may affect, among other things, a firearms dealer’s ability to borrow money or attract investors. It is also often used as a basis for determining certain employee compensation and benefits, such as commissions, bonuses and stock-based compensation. Anticipated revenue may also influence a firearms operation’s tax-planning strategies.

Although it’s not unusual that there is specific time to secure deductions — or to include revenue — until now, the time to claim income and deductions has been dictated by rules or laws, not the firearms dealer or manager’s opinion. Under the guidelines for the new Generally Accepted Accounting Principles (GAAP), most tactical retailers must report the revenue they “expect” to collect for their goods or services.

New accounting guidelines issued by the Financial Accounting Standards Board (FASB) offer requirements for determining how and when income should be accounted for.

Cash Versus Accrual

The cash method of accounting, where income is income when received and deductions secured when paid, is easiest. However, accuracy has long dictated that the accrual method of accounting more closely reflects reality.

The so-called “revenue recognition” principle is a cornerstone of the accrual method of accounting which, with the so-called “matching principle,” determine the time when revenue and expenses are recognized.

According to this principle, revenues are recognized when they are realized or realizable, and are earned (usually when goods are transferred or services rendered), no matter when cash is received.

Revenue = Income — Sometimes

Back on May 28, 2014, the Financial Accounting Standards Board (FASB) — the folks who created the GAAP — and the International Accounting Standards Board (IASB) jointly announced new financial accounting standards for revenue recognition entitled “Revenue from Contracts with Customers (Topic 606).” In general, the new revenue recognition principle states that all businesses that use the accrual basis of accounting should only record revenue when it has substantially completed a revenue generation process. In other words, revenue is to be recorded when it has been earned.

Naturally, all revenue realized during an accounting period is included in a tactical retailer’s income. But, going one step further, the new guidelines require all cash received in either an earlier or a later period than obligations are met (when goods or services are delivered) be recognized and reported along with all related revenue.

Under the new standards, a shooting sports equipment retailer recognizes revenue for promised goods and services to customers and clients in an amount that reflects the consideration they expect to be entitled to in exchange for those goods and services. That expectation is based on the following five, sequential steps:

1. Identify a contract with a customer.

2. Separate the contract’s commitments.

3. Determine the transaction price.

4. Allocate a price to each promise.

5. Recognize revenue when or as the firearms business transfers the promised good or service to the customer, depending on the type of contract.

Obviously, if there is any doubt whether payment will be received from a customer then the seller should recognize an allowance for doubtful accounts for the amount it is expected the customer will renege. If there is substantial doubt that any payment will be received, the tactical retailer should not recognize any revenue at all until a payment is actually received.

In some cases, the updated guidance results in earlier revenue recognition than in current practice. This is because the new standards require a shooting sports equipment retailer to estimate the effects of sales incentives, discounts and warranties.

If a tactical retailer receives payment in advance, it is recorded as a liability, not as revenue. Only after all work has been completed can the payment be recognized as revenue. Of course, if there is substantial doubt that any payment will be received, then the shooting sports equipment business should not recognize any revenue until a payment is received.

Compensation “Ifs”

Because many businesses have compensation plans for managers, sales personnel, shareholder/employees, executives or others that are tied to revenue, compensation arrangements are emerging as a big concern under the new revenue recognition standard. In fact, many of those already implementing the new standards are encountering challenges with compensation policies.

The new standards result in earlier recognition of revenue that, in turn, often leads to higher commissions or bonuses. In other words, for some firearms dealers, the new accounting standard will change the timing of when revenue is recognized, and therefore may change the way compensation is awarded under existing profit-sharing arrangements.

Accounting for Taxes

Nearly all shooting sports equipment businesses will be affected by the expanded disclosure requirements, including the required financial statement footnote disclosures. Not too surprisingly, also impacted will be the tax picture — and bills — of many tactical retailers.

The tax laws have long required businesses to obtain the IRS’s consent before changing a method of accounting for federal income tax purposes. In most cases, a taxpayer who wishes to change accounting method must apply and secure prior consent.

Fortunately, for some accounting method changes, including complying with the new accounting standards, the IRS provides an automatic procedure for obtaining its consent for the accounting method change. Even the so-called “automatic” procedure requires adjustments to reflect changes in income amounts or deductions as well as the final tax bill for the year of change.

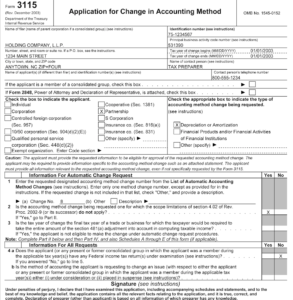

The IRS’s latest procedure for an accounting method change applies to a shooting sports equipment business that wants to change its method of accounting for the recognition of income for federal income tax purposes to a method under the new Standards. In general, a firearms dealer uses Form 3115, Application for Change in Accounting Method, for an accounting method change.

Ground Rules for Deductions And Income

Nearly all businesses will be affected by the expanded financial disclosures required under the new revenue recognition guidelines. When claiming deductions or write-offs and timing the receipt of income under the new guidelines, there are a number of crucial steps every firearms dealer should take, such as:

* File a valid tax return. There are options such as filing an amended return, but there could be problems if the operation’s tax returns are not filed or not filed on time. Obviously, elections to take a deduction or defer income do exist, however it is usually only with a timely-filed return (either by the due date, or if with an extension, the extended due date).

* Claim of right. If the business receives an amount that is not really income (e.g., a deposit) but the operation has unrestricted use of the money, it must now be reported as income.

* Theft loss. As under the current accounting guidelines and tax laws, deductions for theft losses can be claimed only in the year the theft is discovered.

* Casualty loss. As with theft losses, an accounting or tax deduction is only allowed in the year of the loss. Naturally, losses can’t be taken if an insurance reimbursement is anticipated.

* Bad debts and worthless stock. These losses can only be taken in the year that either the debt or stock becomes worthless. Obviously, determining the year of worthlessness can still be tricky.

* Timing. While the effective date for public companies is the 2018 reporting year and others beginning for years after December 15, 2018, the new guidelines permit tactical retailers to apply the requirements retrospectively to all prior periods, or in the year of adoption. Addressing some areas of the new guidelines may require longer lead-time, particularly when it comes to revenue or billing systems where separation and/or allocation changes may be required.

Changes Now and Later

As the new accounting standards kick in, the effect of the required changes that will be experienced will vary greatly by industry. Businesses that currently follow specific industry-based GAAP, such as software, real estate, asset management and wireless carriers, will feel the biggest changes.

While the new rules provide guidance for transactions that weren’t addressed completely, such as service revenue and contract modifications, there are a number of notable exceptions such as insurance contracts, leases, financial instruments, guarantees and nonmonetary exchanges between entities in the same line of business to facilitate sales. These transactions remain within the scope of existing industry-specific GAAP.

The question, “When is a shooting sports equipment business’s revenue considered income?” has been clarified, at least for accountants, tax professionals and the IRS. The effective date for when all businesses will be required to report revenue using the new accounting guidance is almost here. For the average tactical retailer seeking the all-so-necessary professional help in complying is important for avoiding last minute panic and locking in any savings